Listen up, friends! If you're into stocks, trading, or simply curious about the world of finance, you’ve probably heard the buzz around TQQQ. It’s like the rockstar of ETFs, grabbing all the attention from investors big and small. But what exactly is TQQQ, and why should you care? Let’s dive in, because this little ticker symbol could be a game-changer for your portfolio. Don’t just take my word for it; keep reading to find out the full scoop!

TQQQ, or the ProShares UltraPro QQQ, has become a household name in the investing world. It's not just another ETF—it’s a turbocharged version of the Nasdaq-100 Index. Think of it as a race car compared to your regular sedan. While other ETFs might cruise along steadily, TQQQ is built for speed, delivering triple the daily returns of the Nasdaq-100. That’s right, folks, triple the fun—or risk, depending on how you look at it.

Now, before we get too deep into the nitty-gritty, let’s set the stage. TQQQ isn’t for everyone. It’s like spicy food—some people can handle the heat, while others might want to stick with something milder. But hey, if you’re ready to spice up your investment strategy, TQQQ could be the ticket you’re looking for. So, buckle up, because we’re about to explore everything you need to know about this ETF powerhouse.

Read also:Are Faith Hill And Tim Mcgraw Still Together The Full Story Behind Their Love

What is TQQQ and Why Should You Care?

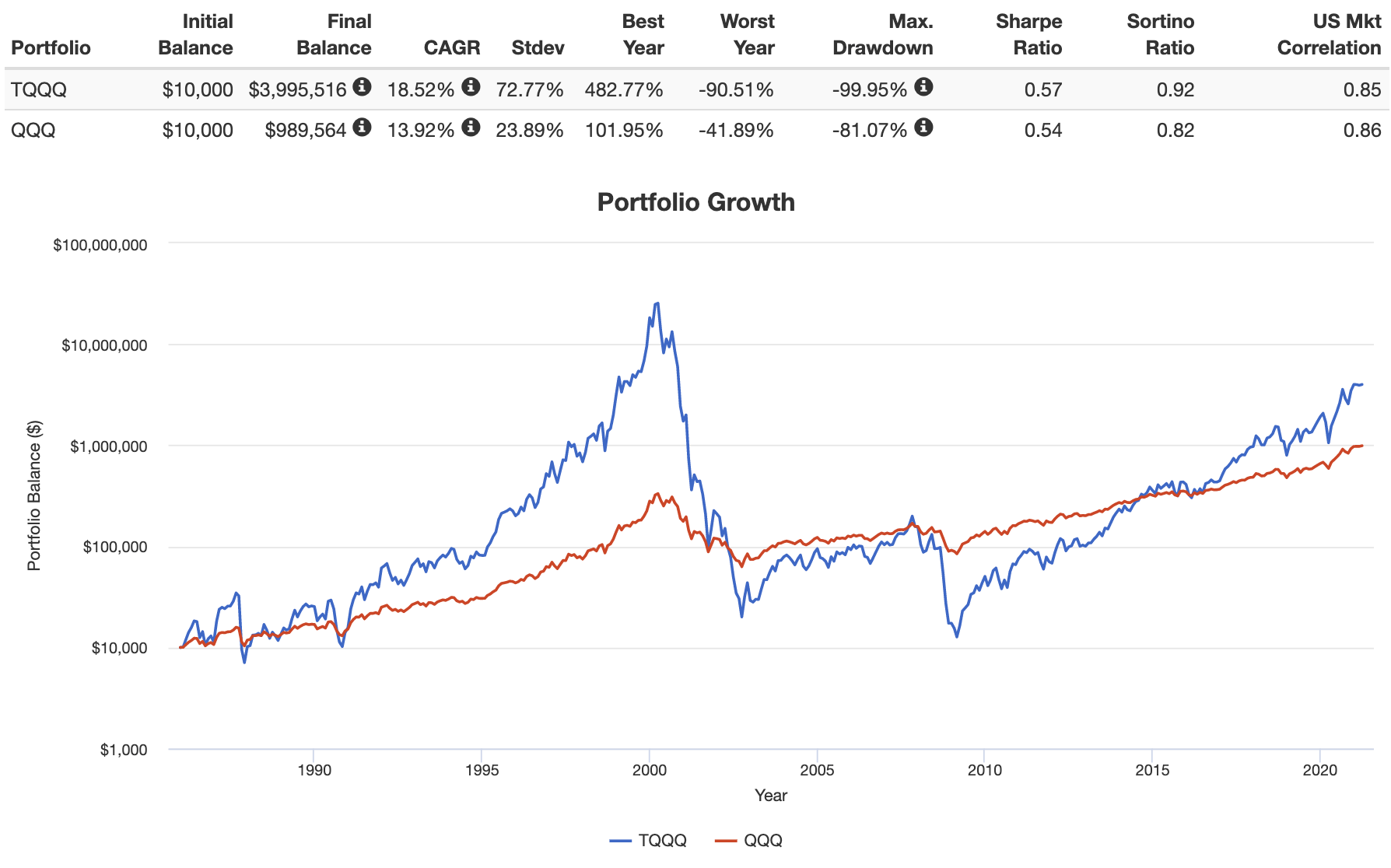

TQQQ stands for ProShares UltraPro QQQ, and it’s essentially an exchange-traded fund (ETF) designed to amplify the daily returns of the Nasdaq-100 Index by three times. If the Nasdaq-100 goes up 1%, TQQQ aims to go up 3%. Simple, right? Well, not exactly. While the math seems straightforward, there’s a lot more to it than meets the eye.

This ETF is perfect for traders who want to capitalize on short-term market movements. However, it’s not ideal for long-term investors due to the compounding effects of leverage. Over time, the performance can deviate significantly from the underlying index. So, while TQQQ might seem like a dream come true during bull markets, it can turn into a nightmare if things take a downturn.

How Does TQQQ Work?

Here’s the deal: TQQQ uses financial derivatives, like futures contracts and swaps, to achieve its 3x leverage. These derivatives allow the fund to amplify the returns—or losses—of the Nasdaq-100. It’s like using a magnifying glass to focus the sun’s rays, but if you hold it too long, you might burn yourself.

Let’s break it down with an example. If the Nasdaq-100 gains 2% in a day, TQQQ aims to gain 6%. But if the Nasdaq-100 drops 2%, TQQQ could lose 6%. That’s why timing is everything when it comes to TQQQ. It’s not a buy-and-hold kind of ETF; it’s more like a high-stakes poker game where you need to know when to fold.

Who Should Invest in TQQQ?

Not everyone is cut out for TQQQ. It’s like skydiving—thrilling for some, terrifying for others. If you’re a seasoned trader who can handle the volatility and has the time to monitor the market closely, TQQQ might be your jam. But if you’re more of a long-term investor looking for steady growth, you might want to steer clear.

Here’s a quick checklist to see if TQQQ is right for you:

Read also:Remembering Jimmy Buffett The Man Who Sang Life Like A Song

- You’re comfortable with high-risk, high-reward investments.

- You have the time and resources to actively manage your portfolio.

- You understand the mechanics of leveraged ETFs and their potential drawbacks.

- You’re not planning to hold onto TQQQ for an extended period.

Risk Factors to Consider

Before you jump into TQQQ, you need to be aware of the risks involved. Here are a few things to keep in mind:

- Volatility: TQQQ is extremely volatile, which means it can swing wildly in either direction.

- Leverage: The 3x leverage can amplify both gains and losses, making it unpredictable over the long term.

- Tracking Error: Due to the daily rebalancing, TQQQ may not perfectly track the Nasdaq-100 over extended periods.

- Market Conditions: In bear markets, TQQQ can suffer significant losses, making it a risky proposition.

The Benefits of Investing in TQQQ

Despite the risks, TQQQ has its advantages. For one, it offers incredible upside potential during bull markets. If the tech sector is booming, TQQQ can deliver massive returns in a short amount of time. Plus, it’s a great tool for hedging against market downturns if used strategically.

Here are some of the benefits:

- High Returns: TQQQ can deliver triple the daily returns of the Nasdaq-100, making it attractive for short-term traders.

- Flexibility: You can use TQQQ to bet on both rising and falling markets, giving you more options in your trading strategy.

- Liquidity: TQQQ is one of the most liquid ETFs on the market, making it easy to buy and sell.

Is TQQQ a Good Long-Term Investment?

Short answer: No. TQQQ is not designed for long-term investing. The daily rebalancing and compounding effects can erode your returns over time, even if the underlying index performs well. It’s like trying to drive a Ferrari on a dirt road—it’s just not built for that kind of journey.

How to Trade TQQQ Successfully

Trading TQQQ successfully requires a solid strategy and a keen eye on the market. Here are a few tips to help you navigate the choppy waters:

- Set Clear Goals: Know what you want to achieve with TQQQ before you start trading.

- Use Stop-Loss Orders: Protect your investments by setting stop-loss orders to limit potential losses.

- Monitor the Market: Keep an eye on market trends and news that could impact the Nasdaq-100.

- Don’t Get Greedy: Take profits when you have them and don’t let emotions cloud your judgment.

Common Mistakes to Avoid

Even the best traders make mistakes, but you can avoid some common pitfalls by being aware of them:

- Holding Too Long: Don’t fall into the trap of holding TQQQ for extended periods.

- Ignoring Fees: Be mindful of the fees associated with TQQQ, as they can eat into your returns.

- Chasing Losses: If TQQQ goes against you, don’t try to chase your losses by doubling down.

TQQQ vs Other Leveraged ETFs

TQQQ isn’t the only leveraged ETF on the block. There are other options out there, like SQQQ, which is the inverse of TQQQ, and TNA, which tracks the Russell 2000 Index. Each has its own strengths and weaknesses, so it’s important to choose the one that aligns with your investment goals.

Here’s a quick comparison:

- TQQQ: Tracks the Nasdaq-100 with 3x leverage, great for tech-heavy portfolios.

- SQQQ: The inverse of TQQQ, perfect for shorting the Nasdaq-100.

- TNA: Tracks the Russell 2000 with 3x leverage, ideal for small-cap exposure.

Which One is Right for You?

The answer depends on your investment strategy and risk tolerance. If you’re bullish on tech, TQQQ might be your go-to. If you think the market is due for a correction, SQQQ could be a better fit. And if you’re looking for small-cap exposure, TNA might be worth considering.

Real-Life Examples of TQQQ in Action

Let’s look at a couple of real-life examples to see how TQQQ performs in different market conditions:

Example 1: During the 2020 pandemic, TQQQ experienced wild swings as the market reacted to the news. At one point, it gained over 100% in a matter of months, only to give back some of those gains when the market corrected.

Example 2: In 2021, as the tech sector soared, TQQQ delivered impressive returns, making it a favorite among traders. However, when the market turned volatile later in the year, TQQQ took a hit, reminding investors of its risks.

Learning from History

History is a great teacher, and studying past performance can help you make better decisions in the future. While past performance is no guarantee of future results, it can give you insights into how TQQQ behaves in different market environments.

Expert Opinions on TQQQ

What do the experts say about TQQQ? Well, opinions are divided. Some see it as a powerful tool for savvy traders, while others warn of its dangers. One thing is clear, though—TQQQ is not for the faint of heart.

Here’s what some experts have to say:

- “TQQQ can be a great way to capitalize on short-term market movements, but it requires constant monitoring.” – Financial Advisor

- “The risks associated with TQQQ are significant, and it’s not suitable for most retail investors.” – Market Analyst

Building Trust in TQQQ

Trust is crucial when it comes to investing, and TQQQ has earned its reputation as a high-risk, high-reward ETF. While it may not be for everyone, those who understand its mechanics and use it wisely can benefit greatly.

Final Thoughts and Call to Action

TQQQ is a powerful tool in the right hands, but it’s not without its risks. If you’re considering adding it to your portfolio, make sure you do your homework and understand the potential downsides. Remember, investing is a marathon, not a sprint, and TQQQ is best used as a short-term strategy.

Now it’s your turn. What are your thoughts on TQQQ? Have you traded it before? Share your experiences in the comments below. And if you found this article helpful, don’t forget to share it with your friends and followers. Together, we can build a community of informed investors who know how to navigate the complexities of the market.