Ever wondered why the VIX is called the "Fear Index"? Well, it’s not just a catchy nickname—it’s a reflection of how investors feel about market volatility. But hold up, before you start relying on the VIX to predict every market move, you need to know its limitations. The VIX is a powerful tool, but it’s not perfect, and that’s what we’re diving into today.

Let’s face it, the financial world can be overwhelming, especially when you’re trying to make sense of all the indicators out there. The VIX, short for the CBOE Volatility Index, is one of the most talked-about metrics in the market. But like any tool, it has its flaws. Understanding these limitations can help you make smarter investment decisions.

Now, don’t get me wrong—the VIX is still super useful. It gives traders and investors a quick snapshot of market sentiment. But if you’re not careful, you might end up misinterpreting what it’s telling you. In this article, we’ll break down the limitations of the VIX, so you can use it more effectively without getting caught in its pitfalls.

Read also:Anderson Cooper Opens Up About Family Tragedy And Life As A Father

Understanding the VIX: What It Really Is

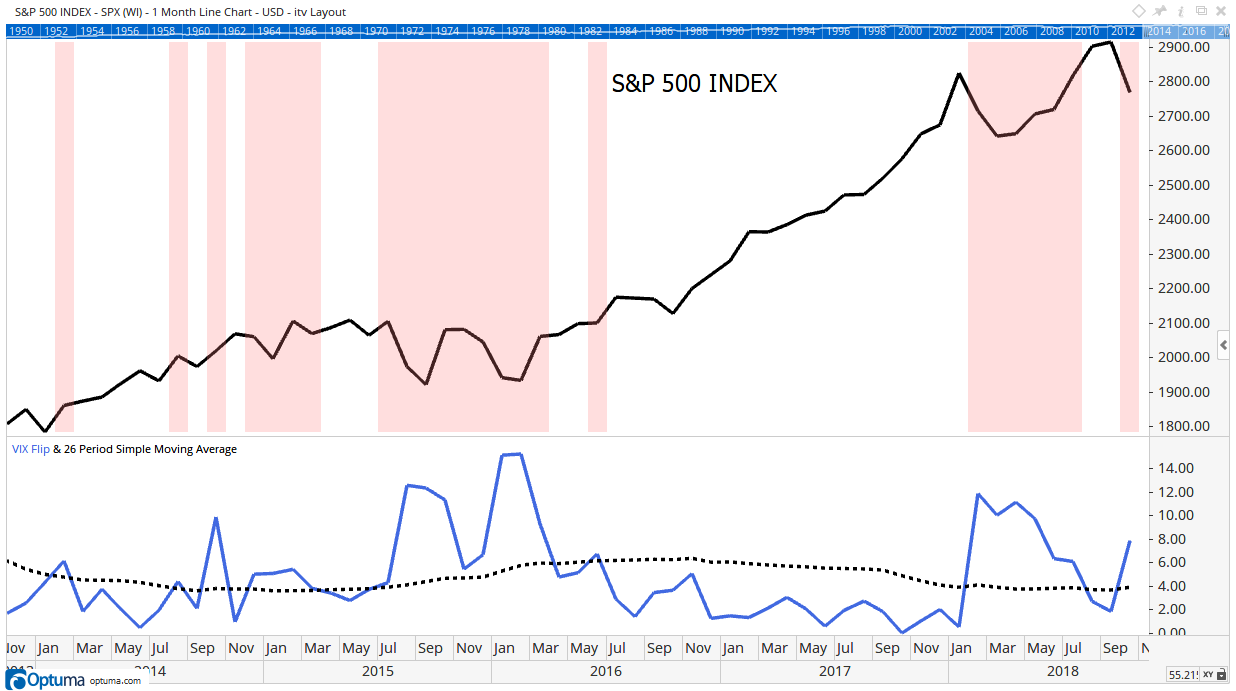

Before we dive into the limitations, let’s quickly recap what the VIX is all about. The VIX measures expected volatility in the S&P 500 over the next 30 days based on options pricing. It’s like a crystal ball for market uncertainty, but instead of predicting the future, it shows how nervous investors are right now.

Here’s the thing though—the VIX isn’t a direct measure of market performance. It’s more like a thermometer for fear and greed. When the VIX spikes, it usually means investors are panicking. But when it dips, it could signal complacency. So, while it’s a great gauge of market sentiment, it doesn’t tell the whole story.

Limitation #1: Short-Term Focus

One of the biggest limitations of the VIX is its short-term outlook. The index only looks at expected volatility over the next 30 days. That’s great if you’re a day trader or swing trader, but if you’re a long-term investor, it might not give you the full picture. Markets can be unpredictable, and a 30-day window might not capture major trends or shifts.

For instance, imagine a situation where the VIX spikes due to a sudden geopolitical event. While the spike might reflect immediate fear, it doesn’t necessarily mean the market is heading into a long-term downturn. Long-term investors need to look beyond the VIX and consider broader economic indicators.

Why Does This Matter?

This short-term focus can lead to misinterpretations. A high VIX reading might scare investors into selling, even if the underlying fundamentals of the market are strong. On the flip side, a low VIX might lull investors into a false sense of security, ignoring potential risks that could emerge later.

Limitation #2: Not a Perfect Predictor

Another limitation is that the VIX isn’t a crystal ball. Just because the VIX predicts high volatility doesn’t mean the market will actually move in a certain direction. Volatility can go up without the market crashing, and it can go down without the market stabilizing.

Read also:Mina Starsiak Hawkrsquos New Hgtv Spinoff A Dream Lake House Journey

Think of it like weather forecasting. A forecast might predict a storm, but that doesn’t mean the storm will actually hit. Similarly, the VIX can signal potential turbulence, but it doesn’t guarantee what will happen. Investors need to be cautious about reading too much into VIX movements.

Real-World Example

During the 2008 financial crisis, the VIX skyrocketed, reflecting extreme fear in the market. But in the years that followed, the market eventually recovered. The VIX was a great indicator of short-term panic, but it didn’t predict the long-term recovery.

Limitation #3: Based on Options Pricing

The VIX is derived from options pricing, which means it’s influenced by how traders perceive risk. This can lead to discrepancies between the VIX and actual market movements. If traders overestimate or underestimate risk, the VIX might not accurately reflect market conditions.

For example, during periods of low volatility, traders might become complacent and underprice options. This could result in a lower VIX reading, even if the market is actually at risk of a correction. Conversely, during periods of high volatility, traders might overreact, causing the VIX to spike unnecessarily.

How Does This Affect Investors?

Investors who rely solely on the VIX might miss out on opportunities or overreact to market signals. It’s important to cross-check the VIX with other indicators, such as economic data, earnings reports, and technical analysis, to get a more complete picture.

Limitation #4: No Directional Guidance

Here’s a biggie—the VIX doesn’t tell you which way the market is going. It only measures volatility, not direction. A rising VIX could mean the market is heading down, but it could also mean it’s heading up. Without additional context, it’s impossible to know for sure.

For example, during a bull market, the VIX might rise due to unexpected events, but the market could still continue its upward trend. Conversely, during a bear market, the VIX might spike as investors panic, but the market could stabilize shortly after.

What Should Investors Do?

Investors need to combine the VIX with other tools to get directional guidance. Technical indicators like moving averages or RSI can help identify trends, while fundamental analysis can provide insights into market drivers.

Limitation #5: Limited Historical Data

The VIX was introduced in 1993, which means it has a relatively short history compared to other market indicators. This limited historical data can make it harder to draw long-term conclusions about its effectiveness.

For example, during the dot-com bubble in the late 1990s, the VIX didn’t have enough data to predict the crash. Similarly, during the 2008 financial crisis, the VIX’s short history meant it couldn’t provide much insight into how the market would recover.

Why Is This Important?

Without a long history, it’s difficult to test the VIX’s reliability in different market conditions. Investors need to be cautious about relying on the VIX for long-term strategies, as it might not have encountered all types of market scenarios.

Limitation #6: Market Sentiment Bias

The VIX is heavily influenced by market sentiment, which can be subjective. Traders’ emotions can skew the index, making it less reliable as an objective measure. For example, during a market rally, investors might become overly optimistic, causing the VIX to drop even if risks are still present.

On the flip side, during a market downturn, investors might become overly pessimistic, causing the VIX to spike even if the market is stabilizing. This emotional bias can lead to misinterpretations of market conditions.

How Can Investors Mitigate This?

Investors should use the VIX as one of many tools in their arsenal. Combining it with objective data, such as economic indicators and company earnings, can help offset the impact of market sentiment bias.

Limitation #7: VIX Futures Aren’t Always Accurate

VIX futures contracts are often used to hedge against market volatility, but they aren’t always accurate predictors of future VIX levels. This can create discrepancies between the spot VIX and VIX futures, leading to confusion among investors.

For example, VIX futures might predict a rise in volatility, but the actual VIX might remain stable. This can cause investors to make misguided decisions based on incorrect assumptions.

What’s the Takeaway?

Investors need to be aware of the differences between the spot VIX and VIX futures. Using both together can provide a more complete picture, but it’s important to understand their limitations.

Limitation #8: Overemphasis on the S&P 500

The VIX is specifically tied to the S&P 500, which means it might not reflect the broader market. While the S&P 500 is a major index, it doesn’t represent all sectors or asset classes. For example, a spike in the VIX might not capture volatility in small-cap stocks or international markets.

This narrow focus can lead to blind spots for investors who are diversified across different asset classes. They might miss out on important signals from other markets, leading to suboptimal decision-making.

How Can This Be Addressed?

Investors should use a combination of volatility indicators for different asset classes. For example, the VXN for the Nasdaq 100 or the OVX for oil markets can provide additional insights beyond the VIX.

Limitation #9: Technical Glitches

Believe it or not, the VIX isn’t immune to technical glitches. Errors in options pricing or calculation can lead to temporary inaccuracies in the index. While these glitches are rare, they can still impact investor decisions if not caught early.

For example, in 2018, there was a brief discrepancy between the VIX and its futures contracts, causing confusion among traders. While the issue was quickly resolved, it highlighted the potential for technical errors in the system.

What Should Investors Do?

Investors should remain vigilant and cross-check the VIX with other sources of information. If something seems off, it’s worth investigating further before making any major decisions.

Limitation #10: Misinterpretation by Retail Investors

Let’s be real—many retail investors don’t fully understand how the VIX works. They might see a high VIX reading and assume the market is crashing, or a low VIX reading and assume everything is fine. This oversimplification can lead to poor investment decisions.

For example, during a market correction, a high VIX might scare retail investors into selling, even if the correction is temporary. Similarly, during a period of low volatility, a low VIX might encourage investors to take on too much risk.

How Can This Be Avoided?

Education is key. Retail investors need to understand the nuances of the VIX and how it fits into their overall investment strategy. Working with a financial advisor or doing thorough research can help prevent misinterpretations.

Conclusion

Alright, let’s recap. The VIX is a powerful tool, but it’s not without its limitations. From its short-term focus to its reliance on options pricing, there are plenty of factors that can impact its accuracy. That’s why it’s crucial for investors to use the VIX as part of a broader strategy, rather than relying on it as the sole indicator.

So, what’s the next step? If you’re an investor, take some time to educate yourself about the VIX and its limitations. Combine it with other tools and indicators to get a more complete picture of the market. And don’t forget to stay calm and rational—market volatility is a natural part of investing.

Got any thoughts or questions? Drop a comment below and let’s keep the conversation going. And if you found this article helpful, don’t forget to share it with your friends and fellow investors!

Daftar Isi

- What Are the Limitations of Using the VIX as a Market Indicator?

- Understanding the VIX: What It Really Is

- Limitation #1: Short-Term Focus

- Limitation #2: Not a Perfect Predictor

- Limitation #3: Based on Options Pricing

- Limitation #4: No Directional Guidance

- Limitation #5: Limited Historical Data

- Limitation #6: Market Sentiment Bias

- Limitation #7: VIX Futures Aren’t Always Accurate

- Limitation #8: Overemphasis on the S&P 500

- Limitation #9: Technical Glitches

- Limitation #10: Misinterpretation by Retail Investors

- Conclusion