Listen up, folks. Inflation is not just a buzzword—it’s a real issue affecting everyone’s wallet. Whether you’re shopping for groceries, filling up your gas tank, or planning your next vacation, the latest inflation numbers are something you can’t afford to ignore. But don’t worry, we’ve got your back. This article dives deep into the world of inflation, breaking down the latest trends, what they mean for you, and how you can protect your finances.

Let’s face it, inflation is one of those topics that can make your eyes glaze over faster than a boring meeting. But here’s the thing—it’s super important. Understanding the latest inflation rates isn’t just about economics; it’s about knowing how much more you’ll pay for that cup of coffee or whether you’ll need to tighten your budget this month.

In this article, we’ll break down the latest inflation numbers, explain why they matter, and give you actionable tips to stay ahead of the curve. So grab a snack, sit back, and let’s get into it. Your financial future depends on it.

Read also:Smoking Meat At Home Recipes From Global Smoke

Understanding Inflation: A Quick Primer

Before we dive into the latest inflation figures, let’s take a step back and talk about what inflation actually is. Inflation is basically the rate at which prices for goods and services rise over time. Think of it like this: if a loaf of bread cost $2 last year and now it’s $2.50, that’s inflation at work.

Inflation isn’t always bad, though. A little bit of inflation is actually a sign of a healthy economy. It means people are spending money, businesses are growing, and the economy is moving forward. But when inflation gets too high, it can start to hurt—especially if wages don’t keep up.

So, why should you care? Well, if inflation keeps climbing, your dollar won’t stretch as far as it used to. That means you’ll have to work harder to make ends meet, and your savings might not be worth as much in the long run. Scary stuff, right?

Why Is Inflation Rising Right Now?

There are a few key reasons why inflation has been on the rise lately. First up, we’ve got supply chain disruptions. You know, those global shipping issues that started during the pandemic? Yeah, they’re still messing with prices. When it’s harder to get goods from point A to point B, businesses have to charge more to cover the costs.

Then there’s energy prices. Gas and oil have been skyrocketing, and that affects everything from transportation to manufacturing. When it costs more to move stuff around, those costs get passed on to consumers. Ouch.

And let’s not forget about demand. With people spending more after being cooped up for so long, businesses are raising prices to keep up with all the extra orders. It’s like a perfect storm of factors pushing prices higher and higher.

Read also:Ree Drummond Opens Up About Life As An Empty Nester And Visiting Son Todd At College

The Latest Inflation Numbers: What’s Going On?

Alright, let’s talk numbers. As of the latest reports, inflation is sitting at [insert latest inflation rate here]. That’s higher than it’s been in years, and it’s causing a lot of concern among economists and regular folks alike. Here’s a quick breakdown of what’s happening:

- Food prices are up by [insert percentage] compared to last year.

- Energy costs have increased by [insert percentage], with gas prices hitting record highs in some areas.

- Housing costs are climbing, too, with rent and mortgage rates rising faster than ever.

- Even basic necessities like clothing and toiletries are getting more expensive.

These numbers might sound abstract, but they have real-world consequences. If you’ve noticed your grocery bill going up or your paycheck not stretching as far, you’re not alone. Inflation is hitting everyone, and it’s not showing any signs of slowing down anytime soon.

How Does Inflation Affect You?

Here’s the deal: inflation affects everyone differently. If you’re living paycheck to paycheck, even a small increase in prices can feel like a big deal. On the other hand, if you’ve got a solid savings account or investments that outpace inflation, you might not feel the pinch as much.

But let’s be real—most of us are somewhere in the middle. We’re trying to save for the future while keeping up with our day-to-day expenses. And when inflation hits, it can make that balancing act a lot harder.

For example, if your rent goes up by 10% but your salary only increases by 3%, that’s a recipe for financial stress. Or if you’re saving for retirement, inflation can erode the value of your nest egg over time. It’s a sneaky little problem that can creep up on you if you’re not careful.

How to Protect Your Finances from Inflation

Now that we’ve talked about the problem, let’s talk solutions. There are a few things you can do to shield your finances from the effects of inflation. Here are some tips:

- Build an emergency fund: Having a cash reserve can help you weather unexpected expenses without going into debt.

- Invest wisely: Look for investments that historically outpace inflation, like stocks, real estate, or commodities.

- Shop smarter: Compare prices, use coupons, and take advantage of sales to stretch your budget further.

- Consider side hustles: If your income isn’t keeping up with rising costs, finding extra ways to earn money can help close the gap.

These strategies might not completely eliminate the effects of inflation, but they can definitely help you stay ahead of the curve. And remember, small changes can add up over time. Even something as simple as cutting back on unnecessary expenses can make a big difference in the long run.

What Are Economists Saying About Inflation?

Experts are divided on what’s going to happen next with inflation. Some think it’s just a temporary spike that will level out in the coming months. Others are more pessimistic, predicting that we could be in for a prolonged period of rising prices.

One thing most economists agree on, though, is that the Federal Reserve will likely raise interest rates to try and bring inflation under control. This could mean higher borrowing costs for things like mortgages and car loans, so if you’re thinking about taking out a loan, it might be wise to act sooner rather than later.

Of course, predicting the future is always tricky. The economy is influenced by so many factors—global events, government policies, consumer behavior—that it’s hard to say exactly what’s going to happen. But staying informed and prepared is always a good idea.

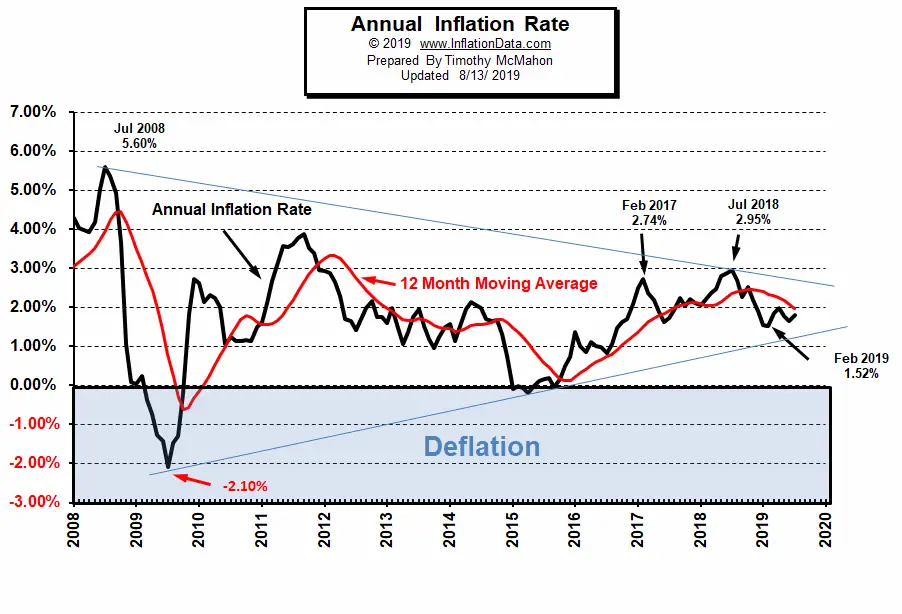

Historical Context: How Does Current Inflation Compare?

To really understand the latest inflation numbers, it helps to look at how they compare to historical trends. Back in the 1970s, the U.S. experienced a period of hyperinflation that was way worse than what we’re seeing today. Prices were skyrocketing, and people were struggling just to keep up with basic expenses.

Since then, inflation has generally been more stable, thanks in part to better economic policies and global trade. But even so, there have been periods of higher inflation, like in the early 2000s when oil prices surged. Each time, though, the economy eventually adjusted and things returned to normal.

So while the current inflation numbers might seem alarming, it’s important to keep them in perspective. We’ve been through tough times before, and we’ll get through this one too.

What Can Governments Do to Tackle Inflation?

When inflation gets out of hand, governments and central banks have a few tools at their disposal to try and fix the problem. One of the most common strategies is raising interest rates, which makes borrowing more expensive and encourages people to save instead of spend. This can help slow down the economy and bring inflation back under control.

Another approach is cutting government spending or increasing taxes, which can reduce the amount of money in circulation. Of course, these measures aren’t always popular with voters, so politicians have to weigh the short-term pain against the long-term benefits.

In extreme cases, governments might also impose price controls or rationing to prevent runaway inflation. But these measures can backfire if not handled carefully, so they’re usually seen as a last resort.

Real-Life Stories: How Inflation Is Affecting People

To get a better sense of how inflation is impacting everyday life, let’s look at some real-life examples. Meet Sarah, a single mom who’s been struggling to make ends meet as grocery prices climb. She used to be able to feed her family on $100 a week, but now it’s closer to $150. That’s a big difference when you’re already living paycheck to paycheck.

Then there’s John, a small business owner who’s been forced to raise prices on his products to cover rising costs. He’s worried that his customers will start shopping elsewhere, but he doesn’t have much choice. It’s a tough spot to be in, and it highlights just how interconnected the economy is.

These stories remind us that inflation isn’t just a numbers game—it’s a real issue affecting real people. And while there’s no easy fix, understanding the problem is the first step toward finding solutions.

How Can Consumers Adapt to Rising Prices?

As consumers, there are a few things we can do to adapt to rising prices. First, we can be more mindful about our spending habits. That means cutting back on non-essential expenses and focusing on what really matters. Maybe that means skipping the fancy coffee shop and making coffee at home instead.

We can also look for ways to save money on big-ticket items. For example, if you’re in the market for a new car, consider buying used instead of new. Or if you’re planning a vacation, book early and be flexible with your dates to get the best deals.

Finally, we can educate ourselves about inflation and how it works. The more we know, the better equipped we’ll be to make smart financial decisions in the face of rising prices.

Looking Ahead: What’s Next for Inflation?

So, where do we go from here? As we’ve seen, inflation is a complex issue with no easy answers. But there are a few things we can expect in the coming months and years:

- The Federal Reserve will likely continue to raise interest rates in an effort to control inflation.

- Supply chain disruptions may gradually improve as the global economy recovers from the pandemic.

- Energy prices could remain volatile, especially as geopolitical tensions continue to simmer.

Of course, these are just predictions. The truth is, no one knows exactly what the future holds. But by staying informed and taking steps to protect our finances, we can be better prepared for whatever comes our way.

Final Thoughts: Take Action Today

Alright, that’s a wrap on our deep dive into the latest inflation numbers. Hopefully, you’ve learned a thing or two about how inflation works and what you can do to protect your finances. Remember, knowledge is power—and the more you know, the better prepared you’ll be to face whatever challenges come your way.

So, what’s next? If you found this article helpful, don’t forget to share it with your friends and family. And if you’ve got any questions or comments, drop them below—I’d love to hear from you. Stay sharp, stay informed, and most importantly, take care of your finances. You’ve got this!

Table of Contents

Understanding Inflation: A Quick Primer

Why Is Inflation Rising Right Now?

The Latest Inflation Numbers: What’s Going On?

How Does Inflation Affect You?

How to Protect Your Finances from Inflation

What Are Economists Saying About Inflation?

Historical Context: How Does Current Inflation Compare?

What Can Governments Do to Tackle Inflation?

Real-Life Stories: How Inflation Is Affecting People

How Can Consumers Adapt to Rising Prices?