Let’s face it, folks— inflation is one of those topics that makes your head spin, but trust me, it’s something we all need to pay attention to. As we approach 2025, inflation is shaping up to be a major player in the global economic landscape. Whether you’re an investor, a business owner, or just someone trying to stretch their paycheck, understanding what inflation 2025 might bring is crucial for your financial well-being. So, buckle up because we’re diving deep into this economic wild ride!

Inflation isn’t just some buzzword economists throw around at fancy conferences. It’s real, it’s happening, and it affects everything from the price of groceries to the cost of that dream vacation you’ve been planning. By the end of this article, you’ll have a clearer picture of what inflation 2025 could look like and how you can protect yourself from its effects.

Now, before we get into the nitty-gritty, let’s establish one thing: inflation isn’t inherently bad. Sure, it can feel scary when prices go up, but managed properly, inflation is a sign of a growing economy. The key is knowing how to navigate it so you don’t get caught off guard. Ready? Let’s break it down!

Read also:Karen E Laines Complicated Love Life And Family Dynamics Heres What You Need To Know

What is Inflation Anyway?

Before we dive headfirst into inflation 2025, let’s take a step back and define what inflation actually is. Simply put, inflation is the rate at which the general level of prices for goods and services is rising over time. Think of it like this: if a loaf of bread costs $2 today and next year it costs $2.20, that increase is inflation in action.

Inflation happens for a variety of reasons, including demand outpacing supply, rising production costs, and even government policies. While a moderate level of inflation is healthy for an economy, runaway inflation can wreak havoc on people’s wallets. And as we edge closer to 2025, there are signs that inflation might be heating up faster than expected.

Why Should You Care About Inflation 2025?

Here’s the deal: inflation 2025 isn’t just about numbers on a chart. It’s about your day-to-day life. Imagine going to the grocery store and finding that your favorite cereal is now 15% more expensive. Or maybe you’re thinking about buying a new car, only to discover the price has jumped significantly since last year. These aren’t hypothetical scenarios—these are real possibilities as we head into 2025.

But here’s the good news: by understanding inflation trends and preparing for them, you can minimize the impact on your finances. Whether you’re saving for retirement, planning a big purchase, or just trying to make ends meet, staying informed is your best defense.

Key Drivers of Inflation in 2025

Global Supply Chain Issues

Remember the supply chain disruptions caused by the pandemic? Well, guess what—they’re not entirely gone. Experts predict that lingering supply chain issues will continue to drive up prices in 2025. From shipping delays to labor shortages, these challenges are keeping costs high and passing those expenses onto consumers.

Energy Prices

Energy costs are another big factor influencing inflation 2025. With ongoing debates around renewable energy and geopolitical tensions affecting oil production, energy prices are expected to remain volatile. This not only impacts your gas bill but also affects industries that rely heavily on energy, like manufacturing and transportation.

Read also:Rosemary Clooney The Triumphs Tragedies And Resilience Of A Hollywood Icon

Wage Growth

On the flip side, wage growth can also contribute to inflation. As workers demand higher pay to keep up with rising living costs, companies may pass those increased labor costs onto consumers. While higher wages are great for employees, they can exacerbate inflation if not managed carefully.

Predictions for Inflation 2025

Central Bank Policies

Central banks around the world play a crucial role in managing inflation. In 2025, many experts expect central banks to continue raising interest rates to combat rising prices. While this can help stabilize inflation, it also makes borrowing more expensive, which could slow down economic growth.

Consumer Spending Habits

Consumer behavior is another key factor in predicting inflation 2025. If people start spending more aggressively, it could fuel demand-driven inflation. On the other hand, if consumers tighten their belts due to economic uncertainty, it might help keep inflation in check. Only time will tell which way the pendulum swings.

Technological Advancements

Don’t forget about technology! Innovations in automation and artificial intelligence could lower production costs in some industries, potentially offsetting inflationary pressures. However, the transition to these technologies could also create short-term disruptions that temporarily boost inflation.

How Inflation 2025 Could Affect You

Impact on Savings

If inflation rises faster than interest rates, the purchasing power of your savings could erode over time. This means that the money you’ve set aside for emergencies or future goals might not go as far as you hoped. To combat this, consider diversifying your investments or exploring options that offer better returns than traditional savings accounts.

Effect on Investments

Inflation 2025 could also influence investment markets. Stocks, bonds, and real estate may all react differently to rising prices, so it’s important to review your portfolio regularly and adjust as needed. Consulting with a financial advisor can help ensure your investments are aligned with inflation expectations.

Cost of Living

Let’s not forget the everyday impact of inflation on your cost of living. From housing to healthcare to education, these expenses are likely to rise in 2025. Budgeting wisely and finding ways to reduce discretionary spending can help you weather these increases without breaking the bank.

Strategies to Combat Inflation 2025

Build an Emergency Fund

Having a solid emergency fund is essential in times of economic uncertainty. Aim to save at least three to six months’ worth of living expenses to give yourself a financial cushion against unexpected challenges.

Invest in Inflation-Protected Assets

Consider adding inflation-protected assets to your portfolio, such as Treasury Inflation-Protected Securities (TIPS) or commodities like gold. These investments are designed to maintain their value even as prices rise.

Focus on Cost Efficiency

Look for ways to cut unnecessary expenses and focus on what truly matters. This could mean cooking at home more often, carpooling to save on gas, or shopping around for better deals on insurance and other services.

Real-World Examples of Inflation’s Impact

Historical Context

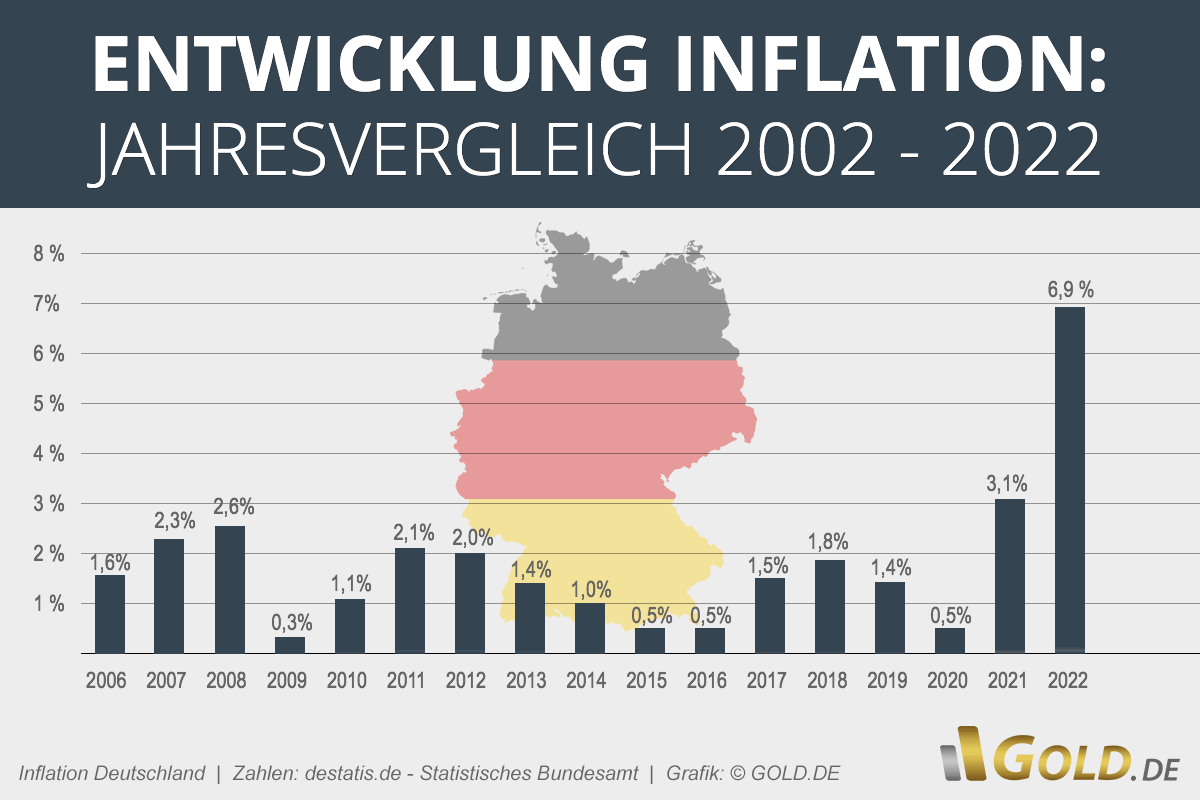

To understand what inflation 2025 might look like, it’s helpful to examine past examples. Think back to the 1970s when runaway inflation caused widespread economic turmoil. Or consider more recent events, like the housing bubble of the early 2000s. Each of these scenarios offers valuable lessons for navigating inflation today.

International Comparisons

Other countries have dealt with inflation in different ways, and their experiences can provide insight into potential solutions. For instance, Germany’s focus on fiscal responsibility during the eurozone crisis offers a model for managing inflation without sacrificing economic growth.

Expert Opinions on Inflation 2025

Economists Weigh In

Leading economists are split on whether inflation 2025 will be a temporary blip or a long-term trend. Some argue that technological advancements will ultimately keep prices in check, while others warn of persistent inflationary pressures. Regardless of their stance, most experts agree that staying informed and proactive is key.

Government Perspectives

Governments around the world are monitoring inflation closely and implementing policies to address its effects. From adjusting interest rates to introducing stimulus packages, these measures aim to balance economic stability with growth. Keeping an eye on government actions can help you anticipate changes in the economic landscape.

Final Thoughts and Call to Action

As we’ve explored in this article, inflation 2025 is shaping up to be a significant economic force. While it presents challenges, it also offers opportunities for those who are prepared. By understanding the drivers of inflation, predicting its impact, and implementing strategies to combat it, you can safeguard your financial future.

So, what’s your next move? Take a moment to review your budget, assess your investments, and start building that emergency fund. Share this article with friends and family to help them get ahead of inflation too. And most importantly, stay curious and keep learning because knowledge truly is power!

Table of Contents

- What is Inflation Anyway?

- Why Should You Care About Inflation 2025?

- Key Drivers of Inflation in 2025

- Predictions for Inflation 2025

- How Inflation 2025 Could Affect You

- Strategies to Combat Inflation 2025

- Real-World Examples of Inflation’s Impact

- Expert Opinions on Inflation 2025

- Final Thoughts and Call to Action